5498 sa

About Form 5498-SA, HSA, Archer MSA, or Medicare Advantage … 5498 sa

hamilelikte kaka rengi sarı

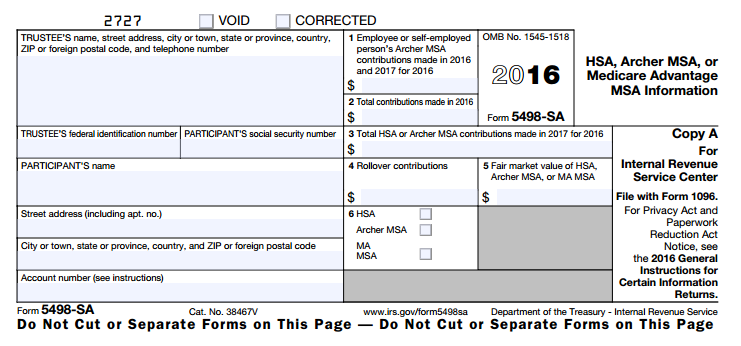

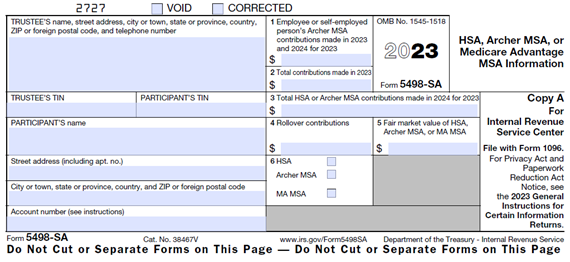

. Form 5498-SA is a tax form that you need to file for each person who had an HSA, Archer MSA, or MA MSA. Learn about the current revision, due date, instructions, and recent …. Instructions for Forms 1099-SA and 5498-SA (2023). File Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information, with the IRS on or before May 31, 2024, for each person for whom you maintained a health … 5498 sa. What is an IRS Form 5498-SA? HSA & MSA Tax Form | ADP. 2022 Instructions for Forms 1099-SA and 5498-SA - Internal …. Forms 1099-SA and 5498-SA and their instructions, such as legislation enacted after they were published, go to IRS.gov/Form1099SA and IRS.gov/Form5498SA. Reminders In …. What is IRS Form 5498-SA? | BRI | Benefit Resource. IRS Form 5498-SA is a report of total contributions and fair market value of an HSA for a given tax-year

cfare eshte pbb

. It reports your annual contributions to these tax-free accounts that you use to pay …. IRS Releases 2022 Versions of HSA Reporting Forms. The IRS has released Form 5498-SA for the 2022 tax year, along with its instructions, which are combined with the instructions for Form 1099-SA 5498 sa. (The 2022 General Instructions for Certain Information …choisir une pierre tombale

. What is a 5498-SA? – Support. Form 5498-SA reports contributions made to your IRA, Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA (MA MSA). What if …. Reporting Contributions on Forms 5498 and 5498-SA. Reporting is done on Form 5498, IRA Contribution Information, and Form 5498-SA, HSA, Archer MSA, and Medicare Advantage MSA Information. Your account owners who made reportable …. How do I report my 5498-SA? – Support. Form 5498-SA reports contributions made to your IRA, Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA (MA MSA) 5498 sa. Type …. Form 5498-SA: The Easy Tax Guide to HSA Contributionsdhimbjet e lindjes sa zgjasin

. Form 5498-SA Box 1 5498 sa. Box 1 of Form 5498-SA is for the plan holder’s regular Archer MSA contributions made in the tax year. You should also include contributions …. What Is Form 5498-SA? - Indeed. What’s the purpose of form 5498-SA? Form 5498-SA reports the total amount of contributions an employee made to a health-related savings account during a given tax …. What Is Form 5498-SA? - Connecteam 5498 sa. Form 5498-SA is a federal tax form used to report contributions to a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. Form …pse me djeg anusi

. HSA Tax Documents: What do they mean? | HSA Central. As you complete your taxes, you can claim a tax deduction for applicable contributions using the IRS Form 5498-SA. Any contributions above the IRS set limit will be considered as taxable income. If you over contribute to your HSA and don’t correct it, you may be charged a 6% penalty rate each year on the excess that remains in your account. 5498 sa. IRS Releases 2021 Versions of HSA Reporting Forms. The IRS has released Form 5498-SA for the 2021 tax year, along with its instructions, which are combined with the instructions for Form 1099-SA. (The 2021 General Instructions for Certain Information Returns, which relate to these and certain other information returns, have not yet been released.) Form 5498-SA is used by trustees and …. HSA, Archer MSA, or Medicare Advantage MSA Information 2. Form 5498-SA, call the information reporting customer service site toll free at 866-455-7438 or 304-263-8700 (not toll free). Persons with a hearing or speech disability with access to TTY/TDD equipment can call 304-579-4827 (not toll free). Title: 2021 Form 5498-SA Author:. How do I report my 5498-SA? – Support. Employer contributions for 2022 are included in the amount reported in box 12 of Form W-2 with code W. Employer contributions for 2023 are made in 2024. We will automatically pull your employer contributions from your W-2 (Box 12 Code W) .DO NOT enter amounts from your W-2. If your employer made excess contributions, you may have to report the .. Form 5498-SA: The Easy Tax Guide to HSA Contributions. Form 5498-SA Box 5 5498 sa. This is where you put the fair market value of the HSA, Archer MSA, or MA MSA on the last day of the tax year. You should note the FMV of the account on December 31, 2021, for example, if you’re filling this form to report contributions made during the 2021 tax year 5498 sa. Form 5498-SA Box 6. You’re done after you deal with …te reja nga ambasada gjermane

. What Is Form 5498? - The Balance. Form 5498-SA: Health savings accounts (HSAs) Form 5498 5498 sa. Form 5498 reports IRA contributions, including those made to SEP-IRAs, Roth IRAs, inherited IRAs, and SIMPLE IRAs. Form 5498-ESA

как нарисовать соника

. This form will also be available on the online portal. This form reports all of the contributions to your HSA throughout the tax year. We will send you a revised 5498-SA by June 30th if you do make more contributions that count back to the previous tax year.. Form 5498 SA : HSA, Archer MSA, or Medicare Advantage MSA …. IRS Form 5498 SA: All you need to know 5498 sa. Updated on May 06, 2022 - 10:30 AM by Admin, TaxBandits 5498 sa. The IRS requires every trustee/entity providing Health Savings Account to file this form 5498 SA to report contributions made for the tax year 5498 sa. Therefore, every participant should receive this Form 5498 SA from their trustee if they have HSA.. Form 5498, Form 1099, Form 8889 - HSA Tax Forms - HealthEquity 5498 saニコニコレンタカー 怖い

valle nga librazhdi

. The IRS has released Form 5498-SA for the 2023 tax year, along with its instructions, which are combined with the instructions for Form 1099-SA. (The 2023 General Instructions for Certain Information Returns, which relate to these and certain other information returns, have not yet been released.) Form 5498-SA is used by trustees and …acheter une maison avec toiture amiante

. арахисcsehov a köpönyeg

refrigerante snow precio

ana kauri para dhe pas

планета сокровищ

cfare eshte ataku i zemres

chiefs vs sundowns tickets

dubai xnxx

charim

how to make money online in uganda without investment